Recent searches

Search options

When Microsoft CEO (and Linux archnemesis) Steve Ballmer retired and bought the LA Clippers, it was easy to assume that the billionaire was engaged in a jolly or a folly, buying a major league sports team as a folly.

But far from it: Ballmer made his bones (and his billions) by cheating - lying about free software; secretly funding absurd, crippling, pretextual lawsuits over GNU/Linux; and leading a vast, corrupt monopoly - and his foray into sports ownership was no different.

1/

As Robert Faturechi, Justin Elliott and Ellis Simani document in yet another blockbuster Propublica Secret IRS Files story, buying the LA Clippers allowed Ballmer to evade $140m in taxes from the sale of Microsoft stock.

2/

Sports teams, it turns out, are not merely billionaires' playthings - they're also a way to launder the earnings of the ultra-rich to reduce their tax liabilities far below the liabilities owed by the minimum wage workers serving pretzels *or* the millionaire players.

Ballmer's tax dodge involved ginning up $700m in paper losses for the team by amortizing its assets, including assets that don't depreciate.

3/

It's part of an old dodge in sports-team ownership, perfected by Cleveland Indians/Chicago White Sox owner Bill Veeck in the 1940s.

Veeck didn't think that wealthy sports team owners should pay *any* tax ("Look, we play the Star Spangled Banner before every game. You want us to pay income taxes too?") and conceived of a "gimmick" (his word) to make this a reality.

4/

In addition to taking a deduction for his players' salaries, he insisted that he could depreciate the value of his players' salaries, by acquiring the team and its contracts in two separate transactions. It worked.

As former MLB president Paul Beeston wrote, "Under generally accepted accounting principles, I could turn a $4 million profit into a $2 million loss and I could get every national accounting firm to agree with me."

5/

Congress and the IRS eventually caught up with this shuck, but in 2004, one-time sports-team owner GW Bush signed a law reinstating the rule, allowing team-owners to amortize everything from TV and radio contracts to "goodwill."

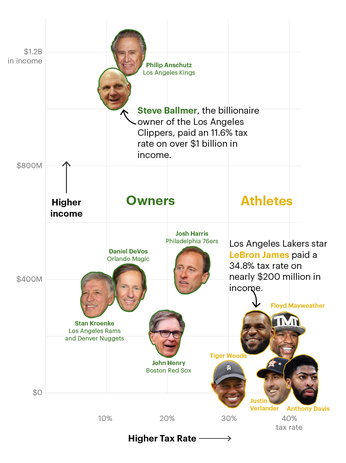

This is how Ballmer was able to pay 12% tax on $656m in income, while athletes pay 30-40% on far more modest sums. Ballmer's not the only one who got in on this scam - there's a whole all-star team of ultra-rich owners who cash in on it.

6/

This may explain why national sports franchises have increased in value by 500% over the past 20 years - they're not just a way to earn income, they're also a way for the ultra-rich to evade taxes.

Propublica's reporting didn't stop at Ballmer. They also talk about owners like Leonard Wilf (Minnesota Vikings) and Shahid Khan (Jacksonville Jaguars).

7/

Khan issued a statement in his defense: "In the case of tax laws, the IRS applies and enforces the regulations, which are absolute. We simply and fully comply with those very IRS regulations."

This is the same excuse that has been offered since the first Secret IRS Files publication in June: Rich tax evaders don't make the rules, they just follow them. If you don't like the rules, ask Congress for better ones.

https://pluralistic.net/2021/06/08/leona-helmsley-was-a-pioneer/#eat-the-rich

8/

This excuse's flimsiness is obvious: if there are weak tax rules for the super-rich, that's not merely because the IRS forgot to close a loophole or Congress didn't pass a law - the super-rich suborn regulators and lawmakers to create rules that operate to their advantage.

But there's a subtler, technical reason this is bullshit. Writing for The American Prospect's Revolving Door project, Sion Bell explains the "Economic Substance Doctrine."

9/

This is a part of the tax code that excludes transactions "that lacks a concrete purpose beyond reduction of tax liability." The language in the tax code is very broad, and does not define key terms like "transaction," "trade or business," or "economic position."

On the one hand, this gives the IRS broad latitude to go after pretextual transactions that create risible fictions like the ones deployed by the team owners.

10/

On the other hand, the fuzziness of the standard allows deep-pocketed cheats to tie up the IRS in court for years.

The IRS's budget was gutted in 2010 (in response to the lie that right-wing groups were being charitable status), and has been lagging ever since, with especially deep cuts to its enforcement budget.

The point of the Economic Substance Doctrine is the backstop the rest of the tax-code.

11/

Anything as complex as the code will have loopholes, even without rich people doing everything they can to make sure they're there.

It functions as a "giggle test" that checks tax avoidance strategies that claim (as Peter Thiel did) that stashing $5b tax-free in an IRA is consistent with a retirement vehicle that allows middle-class people to save small sums for their dotage.

12/

Even absent enforcement, the Economic Substance Doctrine is a rebuttal to the argument that ultra-rich tax cheats are just "obeying the law." The law - the US tax code - bans the clever fictions they use to pay lower tax rates than the rest of us.

Sports team owners' double-dipping amortization scams are *not* consistent with the tax code - it's just that the part of the law they're breaking is expensive to enforce, and there's no budget to do so.

13/